"SBA Thanks You For All The Fish" (santabarbarianlsx)

"SBA Thanks You For All The Fish" (santabarbarianlsx)

02/05/2020 at 14:30 • Filed to: None

0

0

14

14

"SBA Thanks You For All The Fish" (santabarbarianlsx)

"SBA Thanks You For All The Fish" (santabarbarianlsx)

02/05/2020 at 14:30 • Filed to: None |  0 0

|  14 14 |

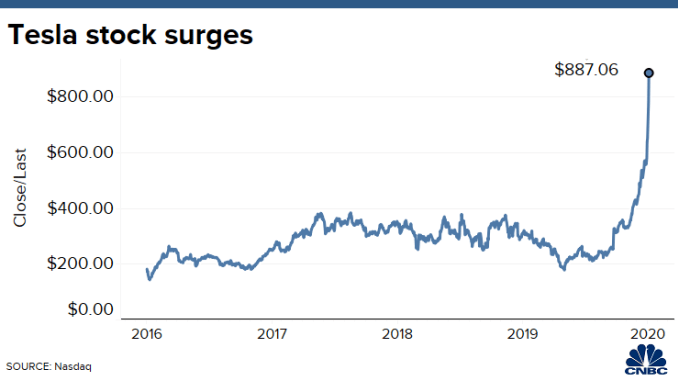

Has the fever broken?

jminer

> SBA Thanks You For All The Fish

jminer

> SBA Thanks You For All The Fish

02/05/2020 at 14:57 |

|

Fear of missing out is strong - ‘What if it’s the next Amazon at $2k per share?! I have to buy at $8 00!!!”

SBA Thanks You For All The Fish

> jminer

SBA Thanks You For All The Fish

> jminer

02/05/2020 at 15:04 |

|

I always wonder who’s on the Buy Side when a bubble bursts and it’s in free fall.

Tim: “Hey, Bob. it’s your broker Tim. Great news. We were able to pick up another 500 shares of TSLA this morning on a dip. We got you in at only $855 a share...”

Bob: “WTF?”

Wobbles the Mind

> SBA Thanks You For All The Fish

Wobbles the Mind

> SBA Thanks You For All The Fish

02/05/2020 at 15:07 |

|

Hard to say today since it seems like profits are being taken out of the tech sector and being used to buy undervalued areas such as energy, financials, industrials, and healthcare. I wouldn’t have the courage to short Tesla yet.

Ash78, voting early and often

> SBA Thanks You For All The Fish

Ash78, voting early and often

> SBA Thanks You For All The Fish

02/05/2020 at 15:13 |

|

I also wonder how many orders just don’t get filled. I take for granted that stable orders get filled in a matter of seconds. In a freefall, I’d imagine large batches are just sitting unsold at the end of the day. Seems scary.

Eric @ opposite-lock.com

> SBA Thanks You For All The Fish

Eric @ opposite-lock.com

> SBA Thanks You For All The Fish

02/05/2020 at 15:21 |

|

Yesterday I thought shorting it would be a good idea. Didn’t do it, but clearly should have.

MrDakka

> SBA Thanks You For All The Fish

MrDakka

> SBA Thanks You For All The Fish

02/05/2020 at 15:41 |

|

I bought in at $865. RIP

Will dollar cost average down once it hurts $600's

M.T. Blake

> SBA Thanks You For All The Fish

M.T. Blake

> SBA Thanks You For All The Fish

02/05/2020 at 16:40 |

|

And here I sit thinking $150 was insane...

SBA Thanks You For All The Fish

> Ash78, voting early and often

SBA Thanks You For All The Fish

> Ash78, voting early and often

02/05/2020 at 17:40 |

|

On Small-Caps that’s certainly the role of the so-called “Market Makers” who step into to buy-hold-trade when there’s a risk of liquidity. Generally, though, those firms try not to have much inventory at day’s end.

I can’t imagine what the Trading Desk orders would have been at Morgan today. They MUST have big institutions with standing orders to build positions on a dip... But there’s a huge swing at play. Nobody wants to hold a $100M adverse position when the trades close out.

The thing traded almost 50 million shares today against a “shares outstanding” of 180 million. That’s huge volume, by any measure.

davesaddiction @ opposite-lock.com

> M.T. Blake

davesaddiction @ opposite-lock.com

> M.T. Blake

02/06/2020 at 09:59 |

|

LOL - it’s crazy...

davesaddiction @ opposite-lock.com

> SBA Thanks You For All The Fish

davesaddiction @ opposite-lock.com

> SBA Thanks You For All The Fish

02/06/2020 at 10:01 |

|

Now 25% off the peak. Crazy.

Earlier post:

https://oppositelock.kinja.com/if-on-january-1-2013-instead-of-buying-a-tesla-model-1841448901

SBA Thanks You For All The Fish

> M.T. Blake

SBA Thanks You For All The Fish

> M.T. Blake

02/06/2020 at 10:04 |

|

On fundamentals? It’s a $20 stock.

SBA Thanks You For All The Fish

> Eric @ opposite-lock.com

SBA Thanks You For All The Fish

> Eric @ opposite-lock.com

02/06/2020 at 10:05 |

|

Timing is the problem. I was using hedges on it for awhile, but these people are truly crazy on the Buy Side. Absolutely religious zealotry.

M.T. Blake

> SBA Thanks You For All The Fish

M.T. Blake

> SBA Thanks You For All The Fish

02/06/2020 at 22:40 |

|

Exactly. I’d prefer to invest like the Berkshire boys - buy things that will never go away. Railroads, Coca Cola, and candy. That shit is permanent.

SBA Thanks You For All The Fish

> M.T. Blake

SBA Thanks You For All The Fish

> M.T. Blake

02/06/2020 at 23:21 |

|

Fruit of the Loom is classic, eh? Everybody needs a place to hold their junk..